All Categories

Featured

Table of Contents

- – What type of insurance policies work best with...

- – What resources do I need to succeed with Wealt...

- – Is Self-banking System a better option than s...

- – What are the tax advantages of Infinite Banki...

- – What type of insurance policies work best wi...

- – How long does it take to see returns from Wh...

Why not treat on your own the exact same means? The principle of Infinite Banking functions just if you treat your personal financial institution similarly you would certainly a regular financial institution. You can also use loans for one of one of the most important points, which is taxes. As a local business owner, you pay a great deal of cash in tax obligations, whether quarterly or each year.

In this way, you have the cash to pay taxes the following year or the next quarter. If you intend to find out much more, look into our previous articles, where we cover what the tax obligation advantages of an entire life insurance coverage plan are. Infinite wealth strategy and exactly how you can pay tax obligations via your system

You can quickly lend money to your business for expenses. You can provide money to your business for payroll. There are numerous kinds of financings that you can make to your service. Afterwards, you can pay that cash back to yourself with individual passion. There is no reason not to do that because it's things that you would be doing regular monthly anyway.

What type of insurance policies work best with Financial Independence Through Infinite Banking?

We used our dividend-paying life insurance coverage plan to purchase a home in the Dominican Republic. It's not enough to just find out about cash; we require to recognize the psychology of money.

Well, we utilized our whole life the exact same means we would if we were to finance it from a bank. We had a mid- to low-level credit rating rating at the time, and the rate of interest price on that automobile would certainly be around 8%.

What resources do I need to succeed with Wealth Building With Infinite Banking?

Infinite Financial is replicating the traditional financial procedure, yet you're capturing interest and growing money rather of the banks. We finish up billing them on a credit report card and making regular monthly payments back to that card with principal and passion.

One of the finest ways to use Infinite Financial is to pay down your financial debt. Infinite Banking offers you control over your financial functions, and after that you actually start to look at the cash differently.

Exactly how numerous individuals are strained with trainee loans? You can pay off your student financial debt and ensure your children' college tuition many thanks to your entire life plan's cash value.

Is Self-banking System a better option than saving accounts?

That allows you to utilize it for whatever you want. You can use your fundings for a selection of different points, but in order for Infinite Financial to work, you need to be sure that you comply with the 3 regulations: Pay on your own initially; Pay yourself interest; Recapture all the cash so it comes back to you.

Most importantly, you can use Infinite Banking to fund your own way of life. You can be your own lender with a way of living banking method.

What are the tax advantages of Infinite Banking Wealth Strategy?

With an entire life insurance policy policy, we have no risk, and anytime we understand what is occurring with our money since just we have control over it. From which life insurance policy firm should I obtain my entire life policy? It will rely on where you live. The only thing you ought to keep in mind is to obtain your entire life insurance coverage policy from one of the shared insurance business.

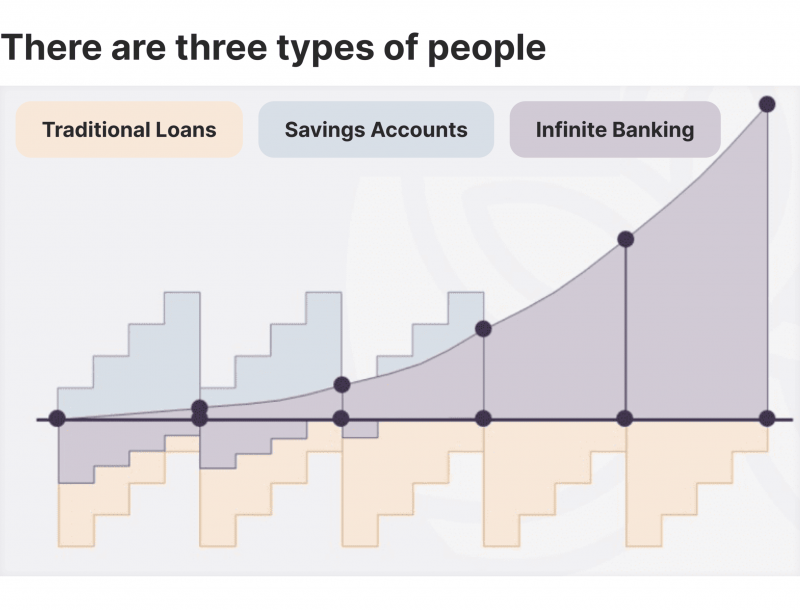

When you put your money into banks, for you, that cash is only resting there. It indicates the sum you place in grows at a certain passion price, however just if you don't utilize it. If you require your money for something, you can access it (under some conditions), yet you will certainly interrupt its growth.

What type of insurance policies work best with Infinite Banking In Life Insurance?

Simply put, your cash is assisting banks make more cash. You can't construct wide range with regular banks because they are doing it instead of you. Yet,.

This allows you to become your very own lender and have more control over your money. One of the advantages is that you can gain substance rate of interest on the funds in your plan, which can possibly grow at a higher rate than conventional cost savings accounts.

This is specifically valuable for organization owners who wish to give their company or leave a considerable amount of wealth for future generations. Flexibility and control: As the plan owner, you have full control over exactly how you utilize the money value in your whole life insurance policy plan. You can select when to access the funds, just how much to secure, and exactly how to utilize them.

We will certainly explore how unlimited banking works, its benefits, the procedure of establishing a policy, the threats and constraints, and options available (Bank on yourself). This blog will certainly offer you with basic details to comprehend the Infinite Banking Idea (IBC) below in Canada. Sorry, your internet browser does not support ingrained video clips. The Infinite Financial Idea is a financial approach that has actually acquired popularity in current times, particularly in Canada.

How long does it take to see returns from Whole Life For Infinite Banking?

The benefit of this method is that the rate of interest rate paid is generally comparable to what a financial institution would certainly bill on a comparable car loan, is commonly tax obligation insurance deductible (when utilized for financial investment functions for example) and the financing can be settled any time without any penalty. By obtaining from the policy's cash money worth a person can develop a self-funded resource of resources to cover future expenses (ie ending up being one's very own banker).

It is critical to recognize that infinite financial is not a one-size-fits-all approach. The performance of unlimited banking as a savings strategy depends on various aspects such as a person's monetary standing and even more. Unlimited banking is an economic idea that involves utilizing a whole life insurance policy plan as a cost savings and financial investment automobile.

It is very important to recognize the structure and sort of Whole Life policy created to optimize this approach. Not all Whole Life plans, even from the exact same life insurance policy business are designed the exact same. Entire life insurance policy is a kind of permanent life insurance coverage that offers insurance coverage for the whole lifetime of the insured individual.

Dividend alternatives in the context of life insurance coverage refer to just how insurance holders can select to use the returns created by their entire life insurance coverage plans. Which is the oldest life insurance business in Canada, has not missed out on a dividend repayment since they initially developed a whole life policy in the 1830's prior to Canada was also a country!

Table of Contents

- – What type of insurance policies work best with...

- – What resources do I need to succeed with Wealt...

- – Is Self-banking System a better option than s...

- – What are the tax advantages of Infinite Banki...

- – What type of insurance policies work best wi...

- – How long does it take to see returns from Wh...

Latest Posts

Be Your Own Bank With The Infinite Banking Concept

Create Your Own Bank

Bank Account Options For Kids, Teens, Students & Young ...

More

Latest Posts

Be Your Own Bank With The Infinite Banking Concept

Create Your Own Bank

Bank Account Options For Kids, Teens, Students & Young ...